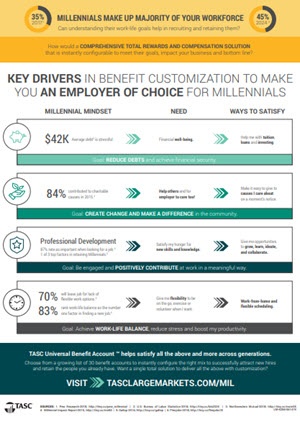

The $42,000 average debt for Millennials1 carries stress that bleeds into the workplace.

Millennials need help with tuition, loans and investing. Tuition and loan reimbursement benefits combined with tax-advantaged Health Savings and Health Reimbursement Accounts can help address debt, grow short- and long-term savings and provide peace of mind. Better still, technologies exist today that enable you to instantly configure the above benefits to keep current employees (whose life circumstances may change daily) and attract potential hires looking for this optimal combination.

Today let’s focus on tuition and loan reimbursement accounts. Come back later for blogs on Health Savings and Health Reimbursement Accounts and dozens of other new benefit accounts and how they are being combined, instantly, to meet multi-generational market demands and give employers a competitive edge in attraction and retention.

Tuition Reimbursement Accounts

Tuition Reimbursement Account plans can be tailored to reflect employer goals. For instance, set up an account to pay for a pre-determined level of continuing education credits or college coursework fees; or link reimbursement to GPA requirements, or only reimburse courses in a certain area of study.

Employees pay for the course, complete it, and submit a request for reimbursement. Upon approval, it pays directly into their account on the employee’s card. Not all solutions offer this card experience. It’s a benefit to employers as well because program costs—up to $5,250 annually, per employee—are tax deductible.

Student Loan Repayment Account

A Student Loan Repayment account makes your company stand out during the recruiting process and improves retention. In fact, a survey by a national lender found 50+% of Millennial employees felt student loan repayment assistance was an important perk and more than 45% of respondents would choose student loan repayment assistance over a 401(k) match if given the choice.2

One option enables the employer to reimburse a designated percentage of an employee’s monthly student loan expenses. Participating employees submit requests and documentation, which are reviewed for eligibility, and the reimbursement is paid directly to the participant. This reimbursement is taxable for employees at a fraction of the cost of their student loans.

When combined with and delivered as part of a single digital benefit experience delivering the level of personalized self-management across all devices that your workforce expects, these accounts, will also drive employee engagement. More than 88% of executives and 85% of benefit managers agree, that benefit programs have the most impact on improving employee loyalty as well as increasing employee engagement.3

Click Image to Download Infosheet

Sources:

-

- Northwestern Mutual-2018; http://tiny.cc/nwm05

- Forbes, 2017 - https://tinyurl.com/debt2017

- Wells Fargo, 2015 http://tiny.cc/wellsfargo2015